Air Travel Slowed for 2019

Latest report from IATA shows revenue passenger kilometers rose by only 4.2 percent in 2019 compared to 7.3 percent in 2018

February 18, 2020

Growth in air travel demand slowed in 2019, according to the 2019 full-year global passenger traffic results from the International Air Transport Association (IATA).

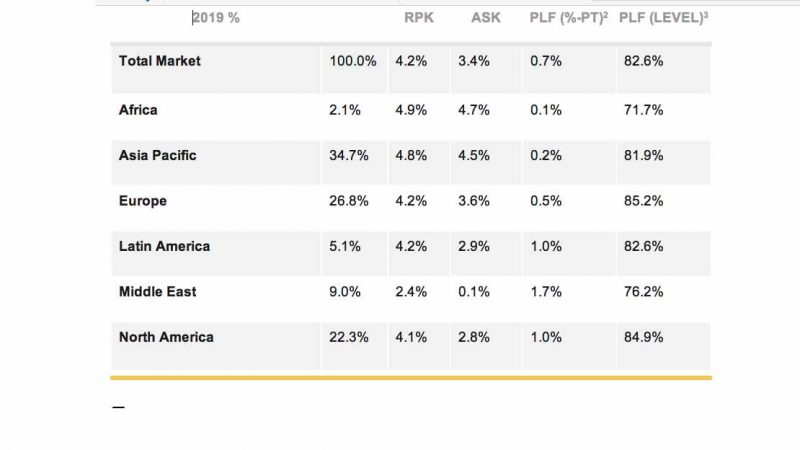

Demand, measured in revenue passenger kilometers (RPK’s), rose by 4.2 percent over 2018, lower than the 7.3 percent growth that 2018 brought over the previous year. It also marked the first year since the global financial crisis in 2009 with passenger demand below the long-term trend of around 5.5 percent annual growth.

December 2019 RPKs increased 4.5 percent against the same month in 2018. That was an improvement over the 3.3 percent annual growth recorded in November, primarily due to solid demand in North America.

“Airlines did well to maintain steady growth last year in the face of a number of challenges. A softer economic backdrop, weak global trade activity, and political and geopolitical tensions took their toll on demand. Astute capacity management, and the effects of the 737 MAX grounding, contributed to another record load factor, helping the industry to manage through weaker demand and improving environmental performance,” said Alexandre de Juniac, IATA’s Director General and CEO.

International Passenger Markets

2019 international passenger traffic climbed 4.1 percent compared to 2018, down from 7.1 percent annual growth the year before. Capacity rose 3.0 percent and load factor edged up 0.8 percentage point to 82.0 percent.

Asia-Pacific airlines’ full-year traffic increased 4.5 percent in 2019, which was a large decline compared to 8.5 percent growth in 2018. This reflected the impact of the US-China trade war as well as weakening business confidence and economic activity. Capacity rose 4.1 percent, and load factor ticked up 0.3 percentage point to 80.9 percent.China’s airlines saw domestic passenger traffic expand by 7.8 percent in 2019, the slowest pace since the global financial crisis. Softer economic activity amid the US-China trade war, compounded by weaker consumer spending and unrest in Hong Kong all contributed to the slowdown. Looking into early 2020, any positive impacts of the ‘phase one’ trade agreement with the US likely will be countered by the impact of the coronavirus outbreak.

European carriers saw a 4.4 percent traffic rise in 2019, which was down from 7.5 percent annual growth in 2018. Capacity rose 3.7 percent and load factor increased 0.6 percentage point to 85.6 percent, which was the highest for any region. The lowered results are attributable to generally slowing economic activity; declining business confidence, compounded by industrial disputes (strikes); Brexit uncertainty and the collapse of a number of airlines.

Middle Eastern airlines’ passenger demand increased 2.6 percent last year, the slowest pace of expansion among all regions and down from 4.9 percent growth in 2018. However, demand began to recover in the fourth quarter and the monthly growth of 6.4 percent in December led all regions. Annual capacity climbed 0.1 percent and load factor surged 1.8 percentage points to 76.3 percent.

North American airlines saw traffic growth slow to 3.9 percent last year, down from 5.0 percent in 2018, amid softer US economic activity and weaker business confidence compared to 2018. Capacity climbed 2.2 percent, and load factor strengthened 1.3 percentage points to 84.0 percent, second highest among the regions.

“2019 was a difficult year for aviation and 2020 is off to a tragic and challenging beginning.

The shooting down of PS 752 in January was inexcusable. Commercial aircraft are instruments of peace, not military targets. To honor the victims of this tragedy we must address this challenge with governments and stakeholders. Our thoughts are also with the injured, and the families of those who lost their lives, in the PC2193 accident in Turkey yesterday. Safety is the aviation industry’s number one priority and we are united in our desire to understand and learn from the circumstances of this tragedy.

“Today, headlines are also focused on the novel coronavirus. From our experience of past outbreaks, airlines have well-developed standards and best practices to keep travel safe. And airlines are assisting the World Health Organization (WHO) and public health authorities in efforts to contain the outbreak in line with the International Health Regulations. There currently is no advice from WHO to restrict travel or trade. But it is clear that demand has fallen on routes associated with China, and airlines are responding to this by cutting capacity for both domestic and international China. The situation is evolving fast, but we are observing significant schedules adjustments for February.” said de Juniac.

IATA (International Air Transport Association) represents some 290 airlines comprising 82 percent of global air traffic.