How Satisfying is Travel These Days? Customers Weigh In

Two satisfaction surveys present the full measure of the travel industry as America climbs out of lockdown

May 2, 2021

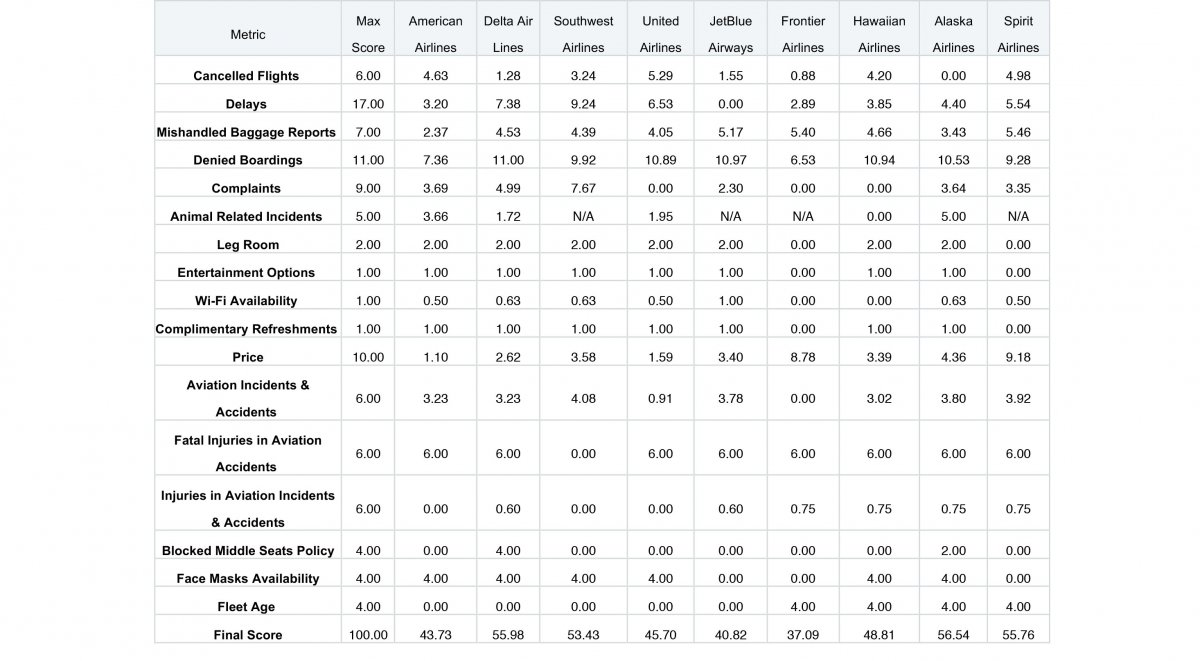

While airlines ramp up toward a post-Covid reality, the year from which they emerge has been entirely without precedent and for which processing currently defies stable prediction. Yet, we all know that travel will and must go on. To that end, WalletHub managed to produce a survey for these odd times that reflect what frequent flyers are thinking and how airlines have fared despite the grand upsets of 2020.

As airlines have had to pivot for leisure destination points to match the changing market demands, leisure travel-focused air fares have hovered at $187 although, already, prices are inching up as travel begins to pick up again. WalletHub’s report on 2021’s Best Airlines sheds light, not just on price, but also many other aspects of the air travel experience, such as safety, delays, baggage issues, animal incidents, passenger complaints and more.

Wallethub Best Airlines Highlights:

Best Overall – Alaska Airlines earned the highest overall WalletHub Score (56.54) for the third year in a row, followed by Delta Air Lines (55.98).

Most Reliable – Southwest Airlines has the lowest overall rate of cancellations, delays, mishandled luggage and denied boardings. The next most reliable company is United Airlines.

Safety – Alaska Airlines is the safest, with a low number of incidents and accidents per 100,000 flight operations, no fatalities and fewer than 15 people injured between 2014 and 2019. Alaska Airlines also has a relatively new fleet of aircrafts. The safety runner-up is Envoy Air.

Most Pet-Friendly – Three airlines tied for being most pet-friendly – Alaska Airlines, SkyWest Airlines and Envoy Air – with no incidents.

Most Comfortable – JetBlue Airways leads the pack in terms of in-flight experience, offering free amenities such as Wi-Fi, extra legroom, and complimentary snacks and beverages. Alaska Airlines, Southwest Airlines & Delta Air Lines are tied for the second position for this category.

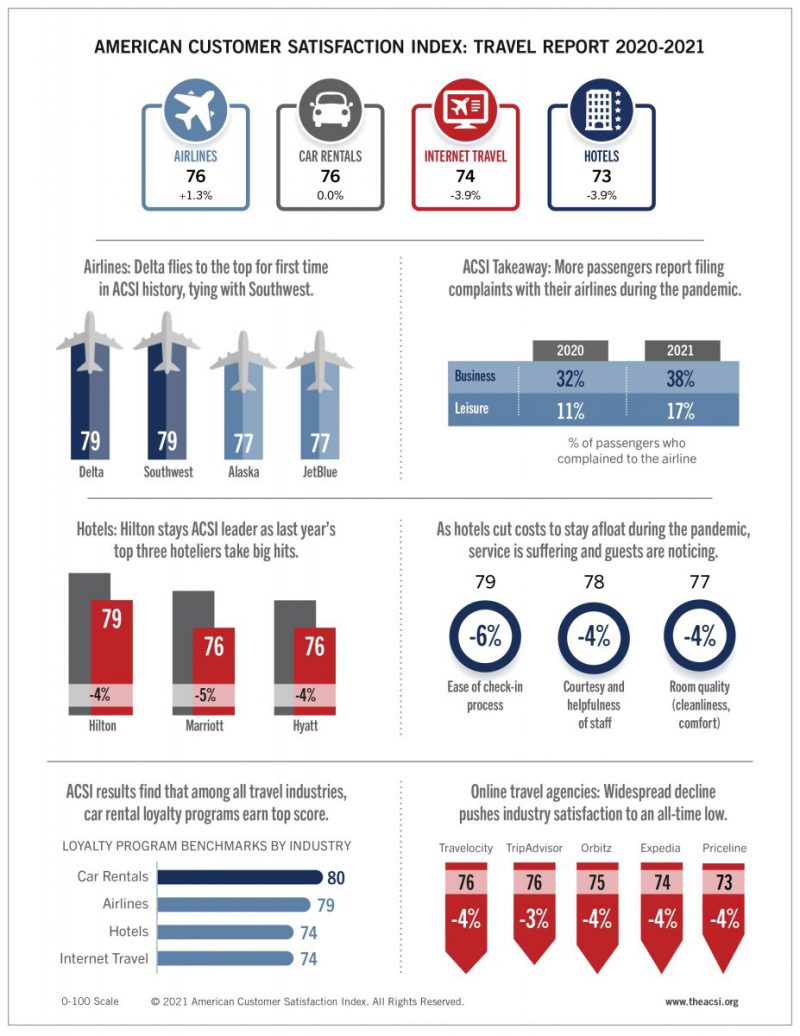

In a separate survey, the annual American Customer Satisfaction Index (ACSI®), that has been in motion as a national economic indicator for 25 years measuring the consumer pulse for 400 companies in 47 industries and 10 economic sectors, airlines fared very well this year in keeping customers happy. Other travel sectors, however, did not get so much approval.

According to the ASCI 2020-21 report, only airlines managed to keep customer satisfaction moving in a positive direction. The car rental industry is holding steady, but guest satisfaction for hotels has headed south as almost every major chain has been experiencing a downward spiral in points. Similarly, satisfaction with online travel agencies has managed to sink to an all-time low.

“Prior to the pandemic, the state of customer satisfaction among airlines and hotels was on the up and up,” said David VanAmburg, Managing Director at the ACSI. “Airlines were soaring, following back-to-back yearly gains in passenger satisfaction, and hotels displayed slight improvement year over year. But COVID-19 has caused these industries to veer in opposite directions. While satisfaction with airlines surprisingly continues to soar, hotels have been hit harder than ever before.”

This report provides customer satisfaction results across four travel industries – airlines, hotels, car rentals, and internet travel services – based on surveys conducted from April 2020 to March 2021.

Delta Ascends to Meet Southwest

Despite the financial strain on the airline industry during the global pandemic, passenger satisfaction has never been higher. The industry overall climbed 1.3 percent to its best-ever ACSI score of 76 (out of 100).

Southwest remained at the top of the industry with an unchanged ACSI score of 79. However, for the first time, Delta shares the number-one position, climbing 3 percent year over year to reach a new high score.

Alaska Airlines and JetBlue both slipped 1 percent to tie for second place at 77. The remainder of the field is running below the industry average, with two major legacy carriers deadlocked at 75: American (up 1 percent) and United (unchanged).

Smaller carriers are making big strides amid the pandemic, up 6 percent to a combined score of 74. Moving in the opposite direction, budget-minded Allegiant fell 3 percent to 72. The bottom of the industry belongs to ultra-low-cost carriers Frontier, which rose 3 percent to 68, and Spirit, which climbed 2 percent to 66.

Hotels Hit Hard

The hotel industry has taken a beating during the pandemic.

Customer satisfaction has not been this low in over a decade, as guest satisfaction overall tumbled 3.9 percent to an ACSI score of 73. The downward trend spans much of the industry, with five of eight major hoteliers posting ACSI declines of 3 percent or higher.

Hilton has remained the industry satisfaction leader, but at a much lower level from the prior year, down 4 percent to 79. IHG earned second place with a stable score of 78. Marriott suffered the sharpest decline in guest satisfaction, tumbling 5 percent to 76. Hyatt joined Marriott in third place after dropping 4 percent to 76, while Best Western is sitting in fourth, slipping 1 percent to 75.

The remaining hotel operators scored below average. Choice ebbed 3 percent to 71, followed by the large group of smaller hotels, down 3 percent to a score of 70. Wyndham is next, slumping 4 percent to 69. Bringing up the rear is G6 Hospitality (Motel 6) – the only hotel operator to improve guest satisfaction – up 2 percent to a high of 66.

Enterprise Holds its Own

Following its ACSI debut in 2020, the car rental industry posted a steady score of 76 in this round.

For the second time, Enterprise Rent-a-Car took the lead in customer satisfaction, despite slipping 1 percent to 78. Dollar made a big move for 2021, rising 4 percent to grab second place at 77.

The remaining car rental companies met or fell below the industry average. Alamo dipped 1 percent to 76, just ahead of three brands deadlocked at 75: Avis, up 1 percent; Hertz, up 1 percent; and National, down 3 percent.

The low end of the industry remains the territory of Budget, Thrifty, and the group of smaller car rental companies. Budget stayed pat at 73, while Thrifty jumped 4 percent to 72. The group of smaller firms – unmoved at 71 – now sit at the bottom of the industry.

The Sinking of Online Travel

For the internet travel service industry overall, user satisfaction plummeted 3.9 percent to an all-time low ACSI score of 74.

Declines in user satisfaction for Travelocity (down 4 percent) and TripAdvisor (down 3 percent) have put the two travel sites in a tie for the industry lead at 76. Orbitz edged in next, stumbling 4 percent to an ACSI score of 75, followed by Expedia’s namesake site, which sank 4 percent to a record low of 74.

At the bottom of the industry, smaller online travel agencies also posted record lows, plummeting 5 percent to 73 and tying Priceline, which plunged 4 percent.

The ACSI Travel Report 2020-2021 on airlines, hotels, car rentals, and internet travel services is based on interviews with 7,898 customers. Respondents were chosen at random and contacted via email between April 1, 2020, and March 28, 2021. The full report is available here.