Most Americans Expect Recession to Follow COVID-19 Pandemic

Meanwhile, monthly spend on pet supplies spike, while food delivery outlays crumble as restricted movements lead to possible global recession

March 26, 2020

Between 80 percent and 90 percent of American consumers said they expect a recession within the year in light of COVID-19, and 89 percent believe their geographic area is affected by the outbreak, according to a survey of 2,608 American consumers fielded on March 18, 2020.

The survey by L.E.K. Consulting, a global management consulting firm, and Civis Analytics, a data science firm, is representative of the general U.S. population and designed to shed light on how consumers’ habits, spending and sentiments are being affected by COVID-19.

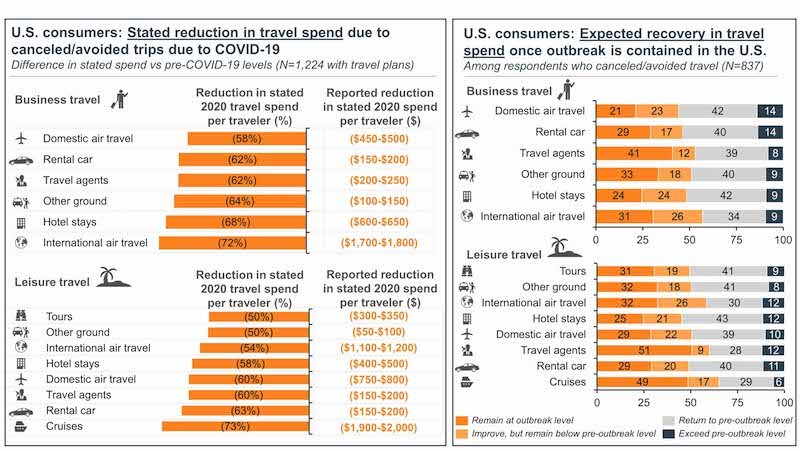

The findings portray the dramatic prospective effect on travel. The nearly 89 percent of Americans who said they’re being affected by the COVID-19 situation have already canceled or ruled out between 50 percent and 75 percent of their 2020 travel spending. Even those few who said their area isn’t affected are dropping their 2020 travel spend by more than a third (37 percent). Travel spend includes airlines, hotels, rental cars, cruises and so on.

“COVID-19 is, of course, first and foremost a human and social crisis. Since businesses play such critical roles in employing, supplying and responding to individuals and society, we think it’s important to contribute insights on what consumers are thinking, how their spending is changing and how they can be better served,” said Manny Picciola, Managing Director at L.E.K. Consulting. “While the true net effect of the outbreak is impossible to determine at this point, we believe moment-in-time snapshots are helpful, and we will endeavor to provide those.”

Americans said the effect on non-travel spending is more muted. Most people said they are spending about 4 percent to 6 percent less than they would if it were not for COVID-19. Interestingly, people who believe the severity of COVID-19 is most critical (18 percent of the population) are spending significantly – 17 percent – more. That jump probably relates to stockpiling, and the others’ dip may relate in part to restrictions on leaving home.

“We are in truly unprecedented times, with a level of uncertainty that many of us have never experienced,” said Ellen Houston, Managing Director of Applied Data Science at Civis Analytics. “Data can help us regain at least some control, allowing us to understand not only where people’s heads are at right now, but eventually predict where people’s heads will be – meaning businesses can make better informed decisions about the future.”

Notable Spending Decreases

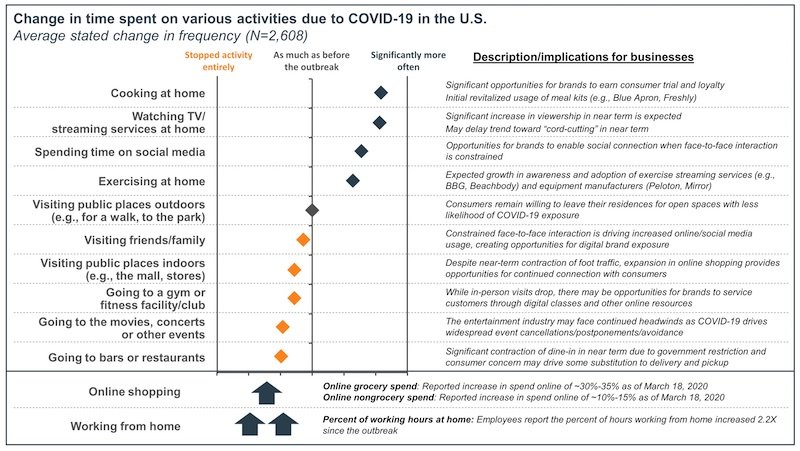

While it’s not surprising that consumers said they’re pulling back 40 percent to 50 percent on such expenditures as dining out, outside-home entertainment and outside home fitness, it’s notable that consumers reported significant drops in other, less “go outside” items and services:

• Consumer electronics – down 25 percent to 30 percent

• Takeout/delivery – down 10 percent to 15 percent

• Beauty – down 5 percent to 10 percent

Notable Spending Increases

At the same time, Americans said their monthly spend is increasing markedly in certain areas:

• At-home fitness – up 35 percent to 40 percent

• Medicine and medical supplies – up 20 percent to 25 percent

• At-home entertainment – up 15 percent to 20 percent

• Groceries – up 15 percent to 20 percent

• Pet supplies – up 10 percent to 15 percent

And consumers said they anticipate their online grocery spend to reach 40 percent of their total grocery spend if the outbreak worsens, and that their online non-grocery spend will reach 45 percent.

“As restrictions and social norms evolve in response to COVID-19, consumers are of course adjusting their broader behaviors, reporting to us more ‘at-home’ activities like cooking, watching TV, social media browsing and exercising at home. These changes create a need for brands to explore how they can meet consumers where they are and engage with them in novel ways, like live digital fitness classes,” said Maria Steingoltz, Managing Director at L.E.K. Consulting.

The survey was fielded online between March 18-20, 2020. Responses from 2,608 U.S. adults were weighted to be representative of the U.S. adult population. L.E.K. and Civis plan to conduct surveys at regular intervals during the COVID-19 crisis.