Optimism Among Travelers Skewing Back To Pre-Pandemic Levels

MMGY Global’s Portrait of American Travelers Survey predicts a strong summer rebound for travel

April 5, 2021

The annual Portrait of American Travelers® Survey by MMGY Global’s research and insights division, has released findings from the 2021 that offers a little optimism and boost in places such findings have been lacking, however, uncertainty still hangs over travel plans after a year like no other.

The “Spring Edition” survey marks the study’s 31st year of publication. Despite the ups and downs of 2020, results are indicating at this time an unprecedented optimism from leisure travelers who are hoping to carry through with their summer travel plans. And while there is much optimism, concerns for safety continue to affect demand.

“It has been a devastating year for the travel industry, but companies have remained incredibly resilient and steadfast in their commitment to meeting travelers’ needs and concerns,” said Chris Davidson, EVP, MMGY Travel Intelligence. “The results from the study show that we are already in the midst of an impressive rebound, and travel companies should leverage these insights and use them to guide their strategies in the months ahead.”

Where Will Travelers Go?

Hawaii, of course. The Aloha State took the top spot for Millennials and Generation X, while Boomers want to head to the Florida Keys and Generation Z is looking toward New York. Affluent travelers (HHI >$150k) are looking at such destinations as the California Wine Country, New York City, Honolulu, New Orleans and Los Angeles.

Some destinations – Portland, Seattle and Washington, D.C. – have experienced large decreases in interest, which is likely the result of extensive political and social unrest that occurred in these destinations throughout the past year. Interest in international destinations is still flagging, remaining steady with some 19 percent of respondents saying they are interested in going abroad some time in the next six months, although a leisure traveler response of 78 percent indicated an itch to travel internationally over the next two years.

As vaccinations are boosting travel optimism, the survey found that 14 percent of would-be travelers say they had no intention of getting one. That number is increasing (only 9 percent in October and November). The survey found that those who say they will not get vaccinated tend to be less affluent and less educated.

For international travel intentions over the next two years, Europe topped the list with Canada, The Caribbean, Mexico and Asia completing the top five. A whopping 68 percent of respondents said they would be more likely to take an international trip if the hotel or airline offered the COVID-19 test at no cost.

The top travel driver is the need for relaxation, although for Gen Z, that would be exploration.

Road trips continue to be the most likely form of near-term vacation travel. Three in five U.S. adults (62 percent) expect to take at least one leisure vacation during the next six months with the preferred mode of transportation being personal car, while two in five (38 percent) say they will take a domestic flight. Looking further out to the next 12 months, four in five (81 percent) U.S. adults expect to take at least one trip.

Preference for hotel over vacation rental or lodge showed no margin in this study: all three checked out at about 56 percent on a scale of unsafe to safe, skewing toward the safe side. For those who miss cruising, only 33 percent of respondents indicated feeling secure enough to booking a sailing in the next few months, but that number is up from a low of 17 percent in 2020.

Interestingly, the survey looked at the “red/blue” divide among would-be travelers in their destination preferences. On the blue side, top destinations targeted include Honolulu, Las Vegas, San Francisco, New York City, New Orleans and Los Angeles. On the red side, in-demand destinations are Florida Keys/Key West, Honolulu, Orlando, Myrtle Beach, Las Vegas, and Nashville.

The Travel Spend

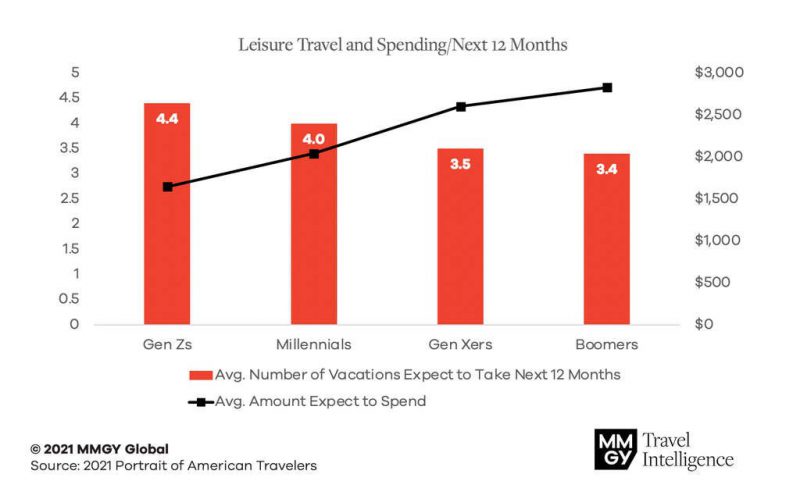

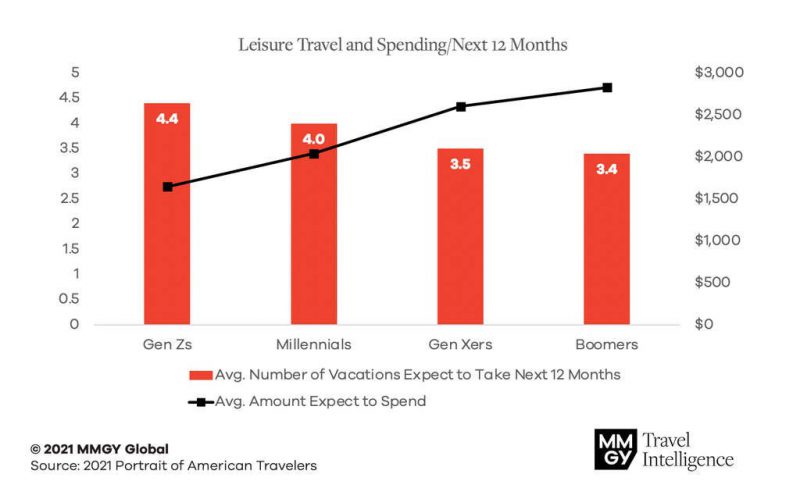

The intent to take a vacation during the next six months decreases with age but increases with household income. Active leisure travelers – those who intend to travel within the next 12 months – expect to take 3.7 overnight leisure trips this year and spend an average of $2,415 on those trips. Gen Xers and Boomers intend to take fewer trips than Gen Zs and Millennials, but these seasoned travelers intend to spend more overall. This difference in spending expectations is likely because Boomers tend to have more available time for travel, more discretionary income, and they’re the generation that’s first in line for COVID-19 vaccinations.

The Bleisure Factor

Corporate business travel demand has historically driven fare and rate strength. However, MMGY Global’s CEO, Clayton Reid, foresees a unique and historic shift in this dynamic ahead.

“MMGY Global believes the next six months will see a unique environment whereby weekend leisure travel demand is so significant that it pushes leisure demand to weekdays, thereby displacing traditional corporate travel. We are calling this ‘reverse compression.’ We think trip volume will not only be led by leisure demand but that fare and rate strength will also come first from consumers and second from business, even in market environments and periods where that just doesn’t happen,” said Reid.

Changing Travel Behavior

The pandemic has had a profound impact on travel behaviors. Travelers are doing more driving than flying, showing preference to outdoor destinations rather than cities and, perhaps unexpectedly, expressing an increasing focus on the impact of their travel. Fifteen percent of active leisure travelers indicate a travel service provider’s focus on sustainability and environmental considerations greatly impacts their travel decision-making. This sentiment is more evident among younger travelers who showed greater willingness to pay more for travel brands that demonstrate environmental responsibility than their older counterparts. Though the intent to spend more with travel companies that demonstrate environmental responsibility declines the older the traveler segment, 83% of active leisure travelers overall indicate they are open to changing some aspect of their travel behavior to reduce their impact on the environment. For example, visiting destinations in the off-season to reduce overcrowding and using less single-use plastics while traveling appear to be changes most are willing to make.

The report was obtained from interviews with 4,500 U.S. adults in February 2021. The four generations of adults surveyed are Gen Zs (18–23), Millennials (24–39), Gen Xers (40–55), Boomers (56–74) and Silent/GIs (75+). This is the first of four quarterly reports to be released this year.