Travel Surveys: Optimism Trumps Fear as Summer Travel Gets Underway

As America gets flying again, traveling consumers turn a blind eye to crowds, discomforts and lingering concerns about COVID

May 25, 2021

The summer prediction travel surveys are running hot off the presses as a continued phalanx of pulse takers are finding in poll after poll that Americans are anxious to get traveling again. A survey released this week from ValuePenguin (a Lending Tree subsidiary) says that 40 percent of Americans will be flying to their vacations in the coming weeks and expect to spend around $2,400 allocated over three trips this summer. Another survey taken by UrVenue (a digital hospitality platform) finds that travelers (85 percent) are expected to prebook multiple experiences and activities with a hotel at a single sitting, most likely directly on the hotel website.

But a comprehensive dive taken by Deloitte & Touche cites not only how eager Americans are to get flying again but also how concerned they remain about the dangers and discomforts of traveling while, in effect, the world is still in COVID mode.

According to the Deloitte Summer Travel Survey, 2021, four in ten Americans plan to take at least one vacation this summer, a percentage similar to pre-pandemic summer travel of 2019. At least 75 percent of travelers are considering factors such as COVID-19 restrictions, crowd avoidance, vaccination status, social distancing and CDC guidelines when selecting their vacation destination. Of those travelers who are working from home these days, more than half (56 percent) will be adding three or more days to their trips. Work from home travelers are twice as likely as other travelers to increase trip budgets from what they were in 2019.

Travel Optimism Amid ConcernsWhile many Americans are ready for a summer vacation, lingering health concerns continue to impact travel decisions. Naturally, COVID-19 remains a leading driver of anxiety even as its lead over financial stress continues to wane. As a result, travelers are incorporating criteria into their travel plans that they would not have considered prior to the pandemic. And for those not traveling, health concerns (41 percent) are a bigger reason than financial concerns (30 percent) to stay home this summer.

• Nearly three-quarters of Americans (71 percent) planning to travel expect at least half of their party to be vaccinated at the time of their trip.

• However, uncertainty around vaccine penetration and infection rates, as well as local attraction capacity and quarantine mandates, is affecting travel plans.

• Despite ongoing health concerns, more than a quarter of travelers (27 percent) plan to visit a city on their summer vacation. Beaches lead all destinations (34 percent), followed by the great outdoors (18 percent).

• Moreover, vacation spending is rebounding, with trip budgets similar to summer 2019. For those willing to spend more than two years ago, middle- to higher-income households are re-prioritizing experiences (35 percent), just as lower-income Americans are redirecting savings for travel (41 percent).

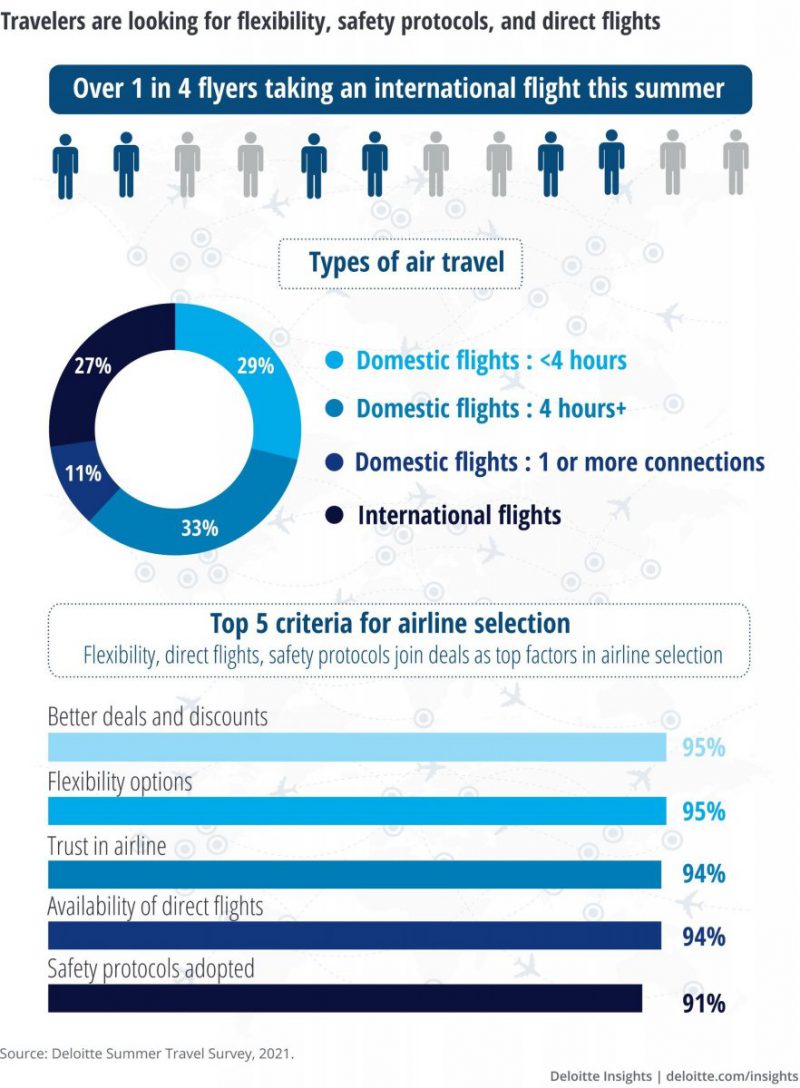

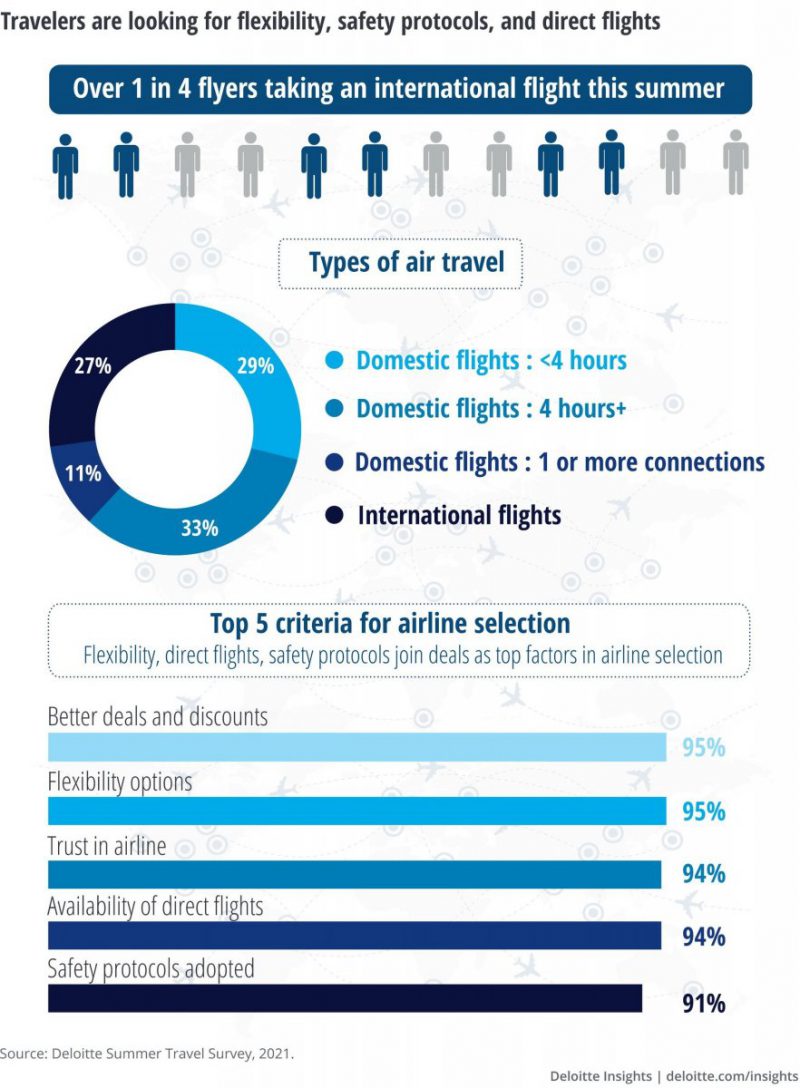

Demand for air travel soars While concerns about air travel persisted throughout the pandemic, demand for flights is now on the rise. More than half (55 percent) of American travelers say their longest trip this summer will include a flight. Amid Transportation Safety Administration reports of increased passenger volume, consumers are also considering new factors for mitigating the health and financial risks of flying.

• Most domestic flyers will opt for a nonstop flight. Only 11 percent of passengers surveyed are considering a domestic itinerary that includes at least one connection, most likely to reduce exposure to airport crowds.

• International travel is on the rise as well. More than 1 in 4 (27 percent) respondents plan to take an international flight this summer, underscoring the lure of global destinations despite continued health concerns.

• While 69 percent of the respondents will reserve their flight directly through an airline’s website, more than half of travelers (57 percent) have not booked any aspect of their trip yet. 18 percent say they will leverage an online travel agency to book the flight for their longest trip this summer.

• Although price is the main purchase driver for flights, new pandemic-driven factors are having an impact as well, including cancelation or rebooking policies, the availability of direct flights, and airline safety protocols.

“As many Americans return to the skies this summer, the impacts of the pandemic continue to influence the entire travel experience, from the time of booking to landing at the final destination. And although travelers are proceeding with caution, airlines have plenty to be optimistic about with summer travel intent near pre-pandemic levels. Still, with ongoing health concerns, airlines should remain flexible to accommodate shifting preferences for direct flights, as well as last-minute reservation and flight changes,” said Anthony Jackson, principal, Deloitte & Touche LLP and U.S. airlines leader.

Private Stays the New Rage

When it comes to hospitality and the many choices available as properties reopen – usually after extensive upgrading, hotels remain the leading form of lodging for most travelers, but the pandemic has also increased demand for private rentals. Still, a majority of summer travelers (85 percent) plan to stay in a hotel, compared to 23 percent who will opt for a private rental.

• More than a quarter (28 percent) of rental travelers have stayed at a private rental for the first time during the pandemic or plan to this summer. Furthermore, two-thirds of pandemic-minted renters say they expect to stay in rentals for at least half of future trips.

• Choosing where to stay is about more than location. For hotel guests, 89 percent cited enhanced safety measures as the main reason for their selection. For those booking a private rental, 86 percent are driven by an amplified sense of control over COVID-19 exposure and their own safety.

• Supply of private rentals is an ongoing issue that leads rental travelers to cross-shop three and a half times more than hotel travelers. For example, 53 percent of rental travelers will consider a hotel for their trip, compared to just 15 percent of hotel travelers considering rentals. The lure of a luxurious hotel experience and loyalty rewards are contributing factors as well.

• An added boon, and not surprising, for both the hotel and private rental sectors, Americans who work from home are more likely to extend their summer vacations to work remotely. Over half of work from home travelers (56 percent) will add three or more days to their vacations, and they are twice as likely to spend more on travel compared with summer 2019, and 1.7 times as likely to plan international travel.

“The pent-up demand for travel, coupled with the flexibility of remote working options, will drive more Americans to hotels and private rentals this summer, as an escape from the everyday. Lodging suppliers have been diligently adapting their policies and offerings since the pandemic began — they should continue to ease traveler safety concerns, instill confidence, bring back the joy of travel and, ultimately, drive loyalty,” noted Ramya Murali, U.S. hospitality sector leader, and principal for Deloitte.